This article also appeared in Finweek Magazine in their 21-March 2013 issue

Prozac, a breakthrough treatment for depression, is one of the biggest-selling, most profitable medications of all time. Since its launch in 1988, Prozac accounted for US$ 21bn in sales and 34% of Eli Lilly’s revenues in that time. In essence Lilly was the house that Prozac built. However, the US patent for Prozac was coming up for expiry in 2001. Executives at Lilly knew that this would trigger such a huge loss of revenue that 2001 was known throughout the company as “Year X”. So how did Eli Lilly prepare for Year X? In South Africa in 1997, Eli Lilly introduced Lilly Fluoxetine, its own generic version of Prozac. But this would eat into sales of Prozac. Why would Eli Lilly conceivably do such a thing?

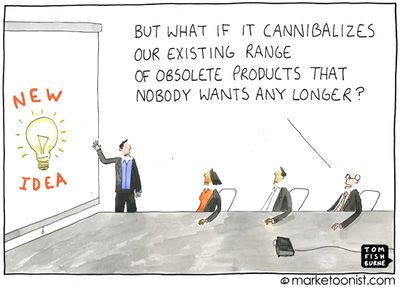

Inevitably, markets are cannibalised. As business leaders, we have a choice: we can either cannibalise our own business lines, or we can enable existing or new competitors to cannibalise it for us. With pricey Prozac coming off patent, it was inevitable that other pharmaceutical companies would jump in to claim their share of the very lucrative antidepressant market. Rather than let competitors grab its Prozac market share with generics, Lilly chose to bring out its own generic. The thinking was that Prozac users could be converted to the cheaper, chemically similar Lilly Fluoxetine, rather than to the competitor antidepressants, and this would prevent some of the Prozac fallout. It was a smart strategy and helped Lilly stay in the antidepressant game.

So why should you cannibalise your own business? And what can happen if you don’t? Continue reading

This article also appeared in

This article also appeared in